It's a little after 8:30 and I headed over to MakersPlace to check out what new work had been posted, and to see if anyone had made an offer on my work.

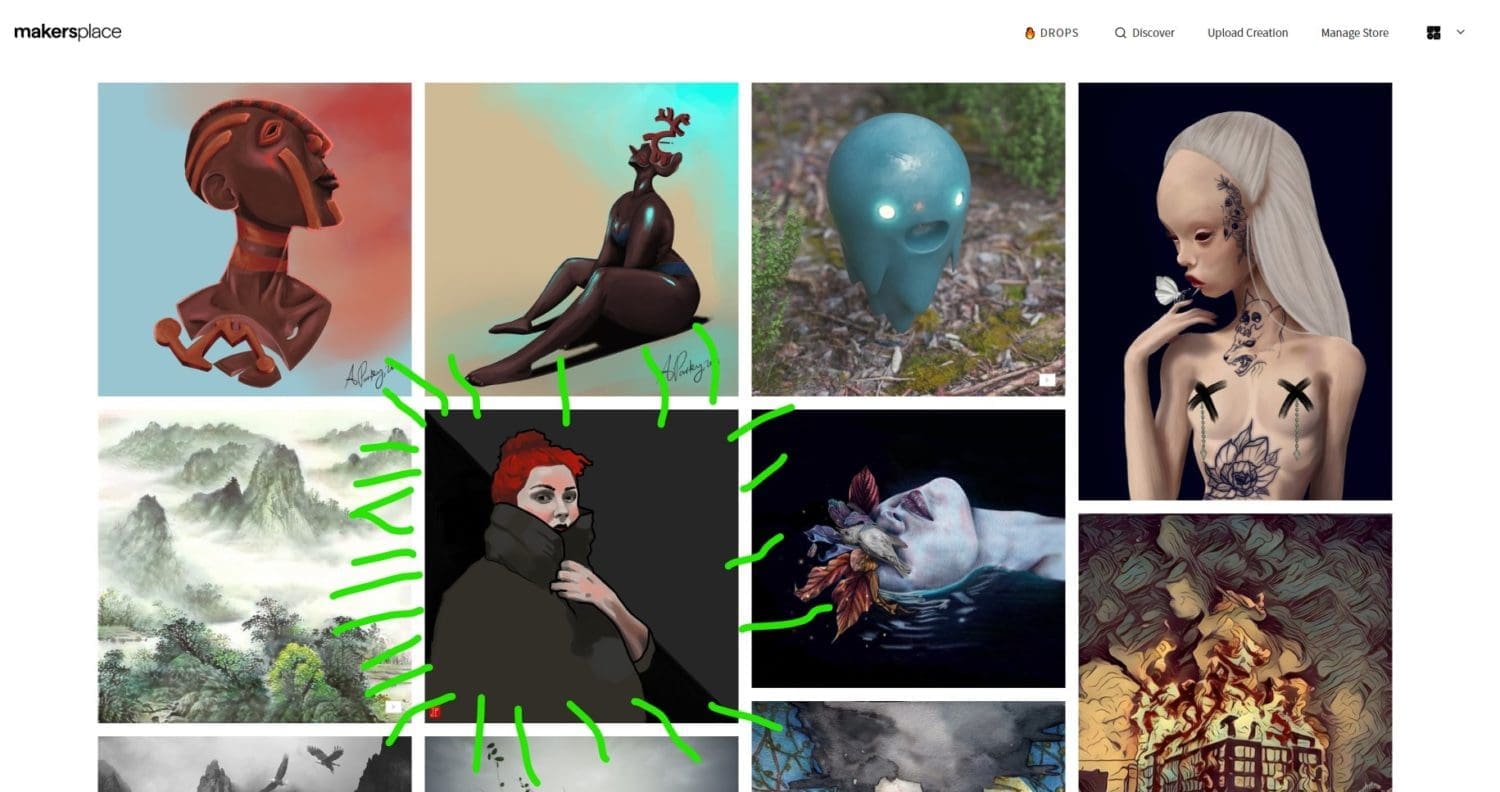

That's when I see this:

☝This is my piece "Winter Chill" featured on the home page! Really cool!

I don't know how they decide what images are presented here, but it's neat nonetheless.

Here it is in a larger (but still smaller than token) size 👇

Non Fungible Tokens are one of the most dynamic, interesting, and powerful new technologies on the horizon.

But "fungibility" is so wrapped in jargon that it can be tough to appreciate why it is so important.

To put it in plain terms: something is fungible if you didn't care which one you got as long as you have one.

Are you standing in line at the grocery store and want one of those Hershey bars? Just grab one. They're all the same.

Want to play a round of Galaga at a retro gaming bar? Use the quarter you picked up from the sidewalk before coming in. Or, use one from the center console of your car. The machine doesn't care which quarter you use as long as you use one.

Something is fungible if it can be easily swapped out for another one like it.

Makes sense, right?

It's something you already understand.

In fact, fungibility is also so blatantly obvious to most people that it feels confusing why we need to explain it in the first place.

But stick with me.

Quarters and candy bars are fungible. You, however, are inherently non fungible.

You are the only you.

Even if you have an identical twin you are still the only you with your exact experiences, hopes, and ideas.

Easy to appreciate.

Now try this on:

When you were a kid your Grandpa gives you a silver dollar for your birthday.

It's special. It's a treasure. You keep it in your pocket every day for decades. Every time you feel it, you feel comforted by its familiarity and a little sad for the family you no longer have.

This silver dollar is not like the others. This one is special.

Here is an important point: it is only special to you.

Physically speaking it looks like just any other coin.

Physically speaking it is just any other coin.

Don't think so? Take it to an arcade and it spends just fine.

The difference between how a machine sees the coin and how you see the coin is called semantics. Meaning.

It is not a difference of substance. You and the machine both understand it is a coin.

It is a difference of meaning.

That coin means 4 more games of Galaga to an arcade. To you it means years of fond memories.

Ok.

What does all this have to do with crypto & blockchain?

You're standing in line at the grocery store, you're bored, so you pull out your phone to check Twitter.

You see a funny meme, and you save the image to your phone. You pop over to Facebook to share it and three hours later your Mom completely ignores the funny image and tells you to call some lady you met once 15 years ago.

Question: did you steal the meme from the original poster?

I'm not asking if they came up with the meme or not. I'm talking about the digital photo.

Did you steal that file from the original poster?

Maybe not.

Theft is usually taking what someone has, and leaving them without it.

In the digital world that doesn't really happen.

You can save the photo to your phone 10,000 times and it's still there with the original poster. If you want to explore this idea a little further, you can check out another article of mine that explains digital scarcity.

The point here is that the digital world is one where you can copy/paste to infinity and nothing is truly limited.

Until Bitcoin.

Bitcoin is a really cool project that uses techno-math-wizardry to create a digital entity (like that photo) that is genuinely & provably scarce.

Again, check out that other article to appreciate why this is important.

While Bitcoin solved the scarcity issue, each Bitcoin (or sliver of Bitcoin) is fungible. You could swap it with any other, and you wouldn't care.

Building on the innovation of provably scarce digital assets, Ethereum comes along.

It does the whole "fungible" trick pretty well with its own asset called "Eth" for short. I don't care what ether I have; just as long as I have some I'm happy.

But it does a lot more than that.

You can create new types of assets on the Ethereum blockchain. It starts with some Eth and then you add the semantic data to it. In our earlier example this is the emotional content and family details about what the coin means to you.

With Eth that data can be anything. A photo, an audio file, blueprints, or whatever.

This process of adding unique details and information to the blockchain is what creates the Non Fungible Token.

How it works is a whole system of "smart contracts" and that's a whole other conversation beyond the scope here.

And now we stick the landing: From this fungible baseline, Ethereum, you can create some "thing" (the Token) that is provably unique (Non Fungible).

Hopefully that gives you a better understanding of what people are talking about when they say "Non Fungible Token" or "NFT."

If you'd like to see all the different shapes and functionality they can take, head over to OpenSea.io which is the world's largest Ethereum-based marketplace where people can buy, sell, and trade NFTs from hundreds (if not thousands) of different projects. Each with their own vibe and nature.

For myself, I sell cryptoprints on two platforms (MakersPlace & KnownOrigin) and each print is a NFT created on the Ethereum blockchain, and once I make it, there can never be another like it.

There are some other exciting projects out there, and now I hope you can appreciate just how awesome they truly are!

You can't buy the Mona Lisa.

You can, however, buy a poster of the Mona Lisa for your wall, and it will cost you $14.95 +shipping & handling.

Even easier you could go to wikipedia, find an incredibly high resolution digital file of the Mona Lisa and download it instantly. It won't cost you a thing.

Scarcity.

There's only one original, hundreds or thousands of prints, and [essentially] infinite number of digital copies available.

Prints are still a physical good limited by the laws of physics. You and I can't hang the same poster on our walls at the same time. If you took my poster, that's called stealing because I wouldn't have my poster any more. You took it!

Digital files, however, have no such restrictions. You can have your image of Mona Lisa, and I can copy it instantly. I haven't taken anything away from you; we each have our own copy as if by magic.

Many people use this quirk to say "it's not stealing! They still have their file, I haven't taken anything away from them!"

But they have.

By making something infinitely available with zero effort they've destroyed its scarcity which reduces its value to near-zero.

We're seeing this play out in the music industry over the past couple decades where torrenting, sharing, and instant streaming have made it incredibly difficult for the artists who create the work to be paid for it.

They've spent lifetime honing their craft to create works of art that only exist because they put their blood, sweat, and tears into making it real.

And as soon as it touches the internet it is replicated again and again to infinity where anyone can grab it with nothing in exchange.

It's a infinite replication crisis.

We've seen a variety of strategies put into place to address this very problem, but they're all lacking.

Patreon seems like a fine solution until you try to use it and you find out just how big a cut they take from fans.

Streaming services love to point to how many millions of times a song has been streamed, and then we find out the musician received a couple hundred dollars after everyone involved has their cut.

And it still doesn't address the infinite replication crisis.

When artwork is uploaded to a blockchain, the image becomes inextricably linked to the "token" that is created. There can only be one of those tokens, and each exchange of ownership is on record forever.

This ensures that the artwork stays scarce even in its digital form.

It also solves the problem of ensuring authenticity and knowing how many people have owned it previously because you can see exactly how many addresses the token has traveled through.

(This does not tell you who owns the addresses, however, but you can trace the token back to its creation, and if the address it was birthed to does not match one from the artist, you have a fake on your hands!)

Not all blockchains are created equal.

While you can technically do some fun stuff like this with Bitcoin (arguably the most well-known blockchain), it lacks the robust metadata built in required for Non-Fungible Tokens (NFT).

There are mainly two blockchains that you can build on right now.

The first is Ethereum. It's the big player on the scene. There's a lot going for it, and there are multiple platforms built on top of it that are specifically made to empower artists to sell cryptoprints.

The two big platforms right now are MakersPlace and KnownOrigin and I have work on both of those. (Clicking the link will take you to my profile on each.)

The second blockchain that enables you to create cryptoprints is RavenCoin. If you want to know more about it directly from one of the lead developers, Tron Black, listen to our conversation on my podcast: The Mind Reader University.

Long story short is that they wanted the security of Bitcoin with the ability to create NFT's like Ethereum, but do both better.

Now it does.

You can create NFT's from your phone instead of requiring an expensive developer like you do with Ethereum. Now you can just fire one up for about $5 and you're good to go.

That's the origin of my company NVRMOR.io which is built on the RavenCoin chain. My goal is to help other artists tokenize their work, and move into the 21st century with a project that people will come to know and trust.

If this stuff interests you, check out Ethereum & RavenCoin. Get ahold of some and then come buy some art.

You can always find what pieces I have on offer in my Virtual Reality Gallery built in CryptoVoxels, which is an Ethereum project, too.

See you in the future!

Cryptocurrencies are having a rough go of it lately, and there's a lot of fear in the market right now with articles like this springing up everywhere:

But, are they really doomed?

Cryptocurrencies aren't an experiment in non-fiat approaches to money. They're an incredibly powerful dynamic that hinges on multiple disciplines like the internet, cryptography, powerhouse computing, and more. It can be a complicated subject, but here's what's at its heart.

Treat crypto as a trading opportunity, and you're going to lose everything. Treat crypto as an investment opportunity, and you have everything to gain.

Take the long view. Speculators are losing their shirts as the brand new market finds its legs. Remember, people tend to vastly over-inflate a new technology's short term capacity, and vastly underestimate its long term possibilities.

Commentators love pointing to the "falling confidence levels" in crypto as a currency, but here's what they're not talking about: crypto's cap isn't based solely on the market's confidence in crypto. Its value is also a function of the market's distrust of traditional fiat.

Crypto and the decentralized approach to transactions are a direct assault on the FED's continued efforts to deflate the dollar's value.

But, before we get bogged down in the "traditional vs. new blood" conversation about fiat vs crypto, let's take a minute to zoom out and ask:

What is crypto good for, anyways?

Bitcoin was lauded as an ideal currency due to its distributed, trustless, cryptography-backed nature, but with transaction fees (or mining incentives if you prefer) skyrocketing, its viability as a day-to-day option for purchasing small goods has evaporated with them.

Is that a bad thing? Not necessarily.

In the history before money, exchanges were done directly. One thing for another; barter.

Bartering is extremely limited. What if I have something you want, but you don't have something I want? No trade is possible, and we both lose out.

And, what if I want to move somewhere else? If all my value is stored in actual goods, I could potentially lose everything I own in one fell swoop.

That's the two purposes of money:

The first money technology was receipts for rice stored in government silos. Then metal coins came along which was a significant advancement in market potential. Now, a single coin could represent massive amounts of actual goods.

Then, along comes paper money, but you have to trust the government who is in charge of printing the money to not print too much of it (otherwise its value goes down due to that pesky supply/demand thing).

Problem with paper currency, however, is its lack of privacy (try moving anything over $10,000. There's a hell of a lot of paperwork. Why should I have to get permission from Dad to get what's mine?), tons of fees (every time someone's involved in a transaction, they get their cut. When completing a payment there are multiple banks, intermediaries, processing houses, etc involved), possibility of false duplicates (forgery, anybody?), and on down the list it goes.

Cryptocurrencies solve all those problems.

At the barter level I have to trust you. On the paper currency level I have to trust the government. On the crypto level I have to trust thousands of years of scientific progress and math.

So, while traditional entities like government benefit from centralized control of fiat currencies, cyptocurrencies offer a bright future & alternative to staying in a rigged game against progress and development.

Buy in for the long haul, and you're betting on human progress.